By Justin Philpott

Are you among the growing population of electric vehicle (EV) drivers? Within that segment, are you among the increasing proportion of EV drivers that have experienced the frustration of attempting to charge their non-Tesla EV at broken, busy, and poor performing charging stations not emblazoned with those five recognizable, red letters atop? I am, and as a patent attorney, I cannot help but think: are patents at fault, or might they be part of a solution? In reviewing the EV charging landscape, a historic opportunity for innovation now presents itself, and patents may provide the key to unlock the full potential of EVs.

For those with limited familiarity of EVs, a brief overview of the state of EV charging is provided, followed by a summary of how early innovators have addressed patents in this space. Next, we compare patent filings in EV charging relative to EV sales over the past decade, to help assess whether innovation is keeping up with demand that could be sufficient to sustain widespread EV adoption. Finally, we conclude with observations of opportunities for patents, indicators of innovation, to show us how we can take EVs from being a clean alternative of the early adopters to having them drive a clean auto industry into the future, where EVs dominate.

The State of EV Charging

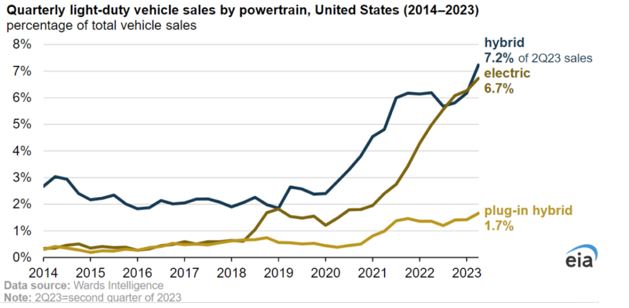

EV charging presents a unique opportunity for the US patent system. Between 2021 and 2023, U.S. EV sales surged from less than 1% of all new vehicle sales to exceeding 7% in 2023 (and 8.1% in Q4 2023).[1] By 2030, EVs are projected to account for about one out of every three new vehicle sale.[2] Meanwhile, the quarterly share of EV sales by market leader Tesla decreased in the past two years from 75% of all new EVs to 50%, as more than 20 auto brands compete for EV market share.[3] EV sales alone suggest a competitive landscape is unfolding, if it is not already upon us.

But EV charging infrastructure is a different story. Tesla reports its more than 45,000 Superchargers across the U.S. have an overall uptime rating to charge an EV 99.95% of the time.[4] However, only Tesla EVs can be charged at Tesla Superchargers, except by agreement between Tesla and non-Tesla EV manufacturers, for example, to address issues such as hardware and software compatibility, and payments necessary for charging. Meanwhile, according to JD Power’s survey, drivers attempting to charge their EVs at non-Tesla charging stations were unable to charge 21.6% of the time.[5] According to JD Power’s survey, “When it comes to reliability [of EV charging stations], no other provider is even close to Tesla.”[6] That may be why nearly every major auto manufacturer has announced, within the past year, that they have reached agreements with Tesla to (eventually) enable their non-Tesla branded EVs to be charged at Tesla fast chargers.[7] Problem solved? Not exactly. According to The American Prospect, “[t]here is now a potential competition problem, where public EV charging in America is increasingly reliant on a single EV manufacturer.”[8] Can we really expect charging fees not to skyrocket when there is a sole supplier exclusively in charge? With signs of a natural monopoly forming, might it be fueled by patents of the industry leader? Or, would more patents (by more applicants) actually lead to greater competition and overall better nationwide EV charging?

Early Innovators – Patent Pledges and Pools

As the EV charging industry speeds towards a monopoly, patents assigned to the most dominant market player may seem a logical target to blame for insufficient competition. This may be especially true for a market struggling so mightily to yield a competent alternative, while simultaneously being boosted by an unprecedented amount of federal funds in an effort to do so. From $2B in charging infrastructure of the “Volkswagen Clean Air Act Civil Settlement” that created Electrify America[9] (in an arguably not-yet-successful effort to energize the EVs of the American auto industry beyond the dominating early entrant), to up to $100,000 in tax credits for each public EV charger installed under the Inflation Reduction Act to expand the market beyond two players,[10] the EV charging industry should be primed for quite a race. Yet, with persistently failing charging experiences nationwide, we still seem far from solving range anxiety plaguing the EV industry, as evidenced from Forbes’ survey highlighting this widespread issue among EV drivers.[11] Electrify America has not been the answer the federal government may have hoped for either. Despite being “the largest fast-charging network in the country after Tesla,” Electrify America is “ranked dead last” in performance, according to the Washington Post.[12] While some other auto manufacturers have announced plans to form a joint venture to launch their own charging stations,[13] whether such an endeavor succeeds still remains to be seen. In any case, their plan to build 30,000 more charging stations with a collective $1B investment is not projected to be fully operational until the end of this decade.[14] In the meantime, with all of the federal funding yet to prove sufficient, and with EV charging of the market leader seeming to be far superior than all present alternatives, might a thicket of patents be standing in the way of successful nationwide EV charging?

Not so fast. The most dominant supplier of EV charging stations has taken the (patent) pledge. Specifically, Tesla has pledged that “it will not initiate a lawsuit against any party” for patent infringement by “good faith” competition “relating to electric vehicles or related equipment.”[15] That public “forbearance of enforcement” has been in effect for nearly 10 years.[16] Further, in late 2022, Tesla announced that its North America Charging Standard (NACS) connector, “a purely electrical and mechanical interface” for EV chargers (that outnumbered competitors’ Combined Charging System (CCS) connectors two-to-one at that time), became open to all, with CAD design files to boot.[17] According to Consumer Reports, the industry has now settled on Tesla’s NACS connector as the de facto standard for nearly all EVs, at least by the 2025 model year, [18] although non-Tesla charging stations matching Tesla’s performance in EV charging experience remain to be seen. Based on Tesla’s pledge and open NACS connector, any argument that the market leader in EV charging during the past decade has stifled competition via patents would seem as misguided as pulling up to a Supercharger station with a battery-drained CCS EV, adapter-less, and expecting to be saved by a NACS fast charger.

Pools of other patents (not assigned to Tesla) likewise may not be to blame for the present state of EV charging infrastructure. For example, VIA Licensing Alliance (VIA LA) was created in May 2023, in collaboration with MPEG LA, to license patents directed to “standards for conductive AC and DC charging,” among other technology.[19] Additionally, Avanci launched its EV charger patent pool in December 2023 directed to cellular communications for “smart” EV chargers.[20] Further, Witricity offers licenses to MIT patents in wireless energy transfer and, while wireless charging may require collaboration with automotive OEMs, Witricity proposes to enable “initial vehicle integration in just three months.”[21] Patent pools such as these may provide EV charging entities with an ease of access to license technology, with known upfront costs, that may reduce risk of litigation for new market entrants and help propel them into a competitive EV charging marketplace. As far as costs go, licensing fees are currently listed at $5 to $40 per charger under VIA LA[22] and $5 to $13 per charger under Avanci.[23] For installations of fast charging stations (e.g., greater than 50kW), such licensing rates would be a small fraction of overall installation cost such that it would seem that patents in these pools should not be posing as barriers to new entrants in the EV charging industry. Patented technology for EV chargers would seem to be reasonably available, then, from both Tesla (at no cost) and from other patentees (at relatively low cost) via several patent pools in this space. But is the rate of patenting in this space keeping up with the demand for new EV charging innovation?

Latest Patent Trends in EV Charging

There is likely no easy fix to America’s EV charging problems. Broken chargers, lack of oversight and maintenance of the Electrify America network, insufficient supply of charging stations, and charging rates far too slow to compete with the gas station fueling experience, EV adoption faces numerous challenges. Scaling new technology, nationwide, with costly infrastructure essential to support it, cannot happen overnight. Tesla persistently built up its network of charging stations for more than a decade. Ambitious followers must be similarly determined in their efforts to establish truly nationwide, dependable, and fast charging if we are to achieve our nation’s goals of EVs making up “half of all new vehicles sold in the U.S. in 2030,” and chargeable by “a convenient and equitable network of 500,000 chargers to help make EVs accessible to all Americans for both local and long-distance trips,” as reiterated by the U.S. Department of Transportation.[24]

With many challenges apparent, and patents not seeming to be among obstacles to EV adoption, could patents actually be part of a solution to our nation’s EV charging problems? An argument could be made that rather than seeing too many EV charging patents, we still see too few. The patent system may not be without its flaws; however, as economists have noted, “[b]y their very nature, we know that patents and innovation are related to one another” and that “patents can direct innovative activity.”[25] A surge in US patent filings for EV charging might reflect a similar surge in innovation. But that is not what we see today.

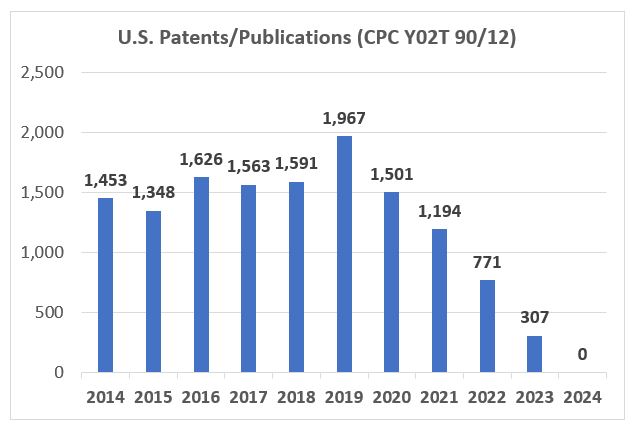

How can we assess the rate of EV charging innovation? The Cooperative Patent Classification (CPC) system categorizes “Electric charging stations” under CPC Y02T 90/12, as a subset of “Technologies relating to charging of electric vehicles.”[26] Tracking patent filings in this technology area can be a reasonable indicator of innovation when it comes to EV charging. The below graph shows collective numbers of U.S. patents and published applications filed in this area in each of the past 10 calendar years.

As shown above, even taking into account an 18-month delay between filing and publishing of pending applications (e.g., all filings from September 2022-to-current may not yet be reflected in these numbers), the collective number of U.S. patent assets covering electric charging stations under CPC Y02T 90/12 peaked in filings of 2019 and has been on a steady decline since then. Not for lack of trying, the U.S. Patent & Trademark Office has encouraged more patent filings for EV charging with its Climate Change Mitigation Pilot Program, by including Y02T among the classifications eligible for expedited examination at no-additional cost to applicants.[27] Time will tell if this incentive provides a spark in the U.S.; however, the phenomenon of lower number of EV charging patent filings does not appear to be limited to the U.S., as a similar trend was observed by Lumenci in its study of granted patent families on a global scale.[28] This decline in patenting stands in stark contrast to the significant surge in EV sales in recent years, as summarized in the following chart, where EVs hovered between 1 to 2% of all vehicle sales from 2019 to 2022 until ending 2023 at around 7%.

To keep up with demand for EVs, the EV charging industry could use a boost in innovation. Even the above-referenced patent pools could arguably benefit from more innovation in this space. For example, Tesla, the leading entity in EV charging, lists at least 45 U.S. patents as among those pledged.[30] In contrast, the entire VIA LA patent pool for EV charging across a total of 7 assignees includes only 36 unexpired U.S. patents.[31] Similarly, while Avanci boasts a total of 44 licensors for wireless communication technology in EV chargers to make them “smart,” its portfolio is arguably old technology―Avanci admits it presently has no 5G patents in the EV charger pool.[32] In fact, while Avanci indicates its pool includes 4G LTE patents (e.g., the precursor wireless communications technology to your latest 5G phone), at least some of the patents in its pool are directed to earlier 2G and 3G wireless communications that have largely been rendered obsolete due to cellular providers disabling such technology (e.g., AT&T, Verizon, and T-Mobile each announced that their 3G networks were shut down in 2022).[33] While EV charging patent pools may be a beneficial step forward, they could stand to benefit from an influx of new technology. And expanding these patent pools will likely require reversing the downward trend of patent filings in EV charging technology. Arguably, more investment made in innovation, and in turn, patent filings, could provide the spark to advance competition in the EV charging space, with faster and more reliable charging systems.

Start Your Electric Motors

Opportunities abound for funding and collaborative research on improvements in EV charging. For example, the U.S. Department of Energy’s Vehicle Technologies Office promotes research to, among other things, “[d]ecrease charge time to 15 minutes or less” in comparison to the current 30+ minute experience to charge from 20% to 80% of a typical EV battery pack using a fast charger (e.g., > 50 kW).[34] As another example, the National Renewable Energy Laboratory of the U.S. DOE is “investigating the requirements and feasibility of wireless electric vehicle charging.”[35] Further, the Small Business Administration of the U.S. Department of Transportation provides funding for small business “to conduct technology research related to EV infrastructure.”[36] And a “$2.5 billion Charging and Fueling Infrastructure Discretionary Grant Program” aims to “complement[] the $5 billion National Electric Vehicle Infrastructure (NEVI) formula program to build the ‘backbone’ of high-speed EV chargers along our nation’s highways.”[37] A need for innovation meets an abundance of opportunities to fund it. Companies large and small, established leaders and pre-seed, all can take advantage of this opportunity with research and development in EV charging. More patent filings in this space can help us navigate the road to what the U.S. Department of Transportation says is “the Federal Government’s strategy to eliminate climate-related emissions from transportation.”[38]

We are at a crossroads for the next stage in EV adoption. Excitement in new technology, such as the thrill of smoother and greater acceleration made possible by an electric engine, the coolness factor of being the first in the neighborhood with an EV, and/or the altruistic desire to reduce carbon footprint, all have helped drive early adopters to EVs. These drivers have been willing to accept some inconvenience, such as a more limited driving range of EVs and fewer options to energize away from home. Many of these drivers also have been willing to pay more than comparably equipped internal combustion engine (ICE) (i.e., gas-powered) vehicles. We are likely nearing a saturation point, where there may not be many more of these early adopters willing to pay more for an EV than an ICE vehicle, and/or to be more inconvenienced than their ICE-driving counterparts. In order to influence the masses necessary for nationwide EV adoption, EVs must attract far more than the early adopters, and they must do it on some combination of: price, performance, and convenience. At least some performance and price metrics have EVs ranked above ICE vehicles already. For example, compared to ICE vehicles, EVs have generally greater acceleration[39], lack engine noise of an ICE, have lower maintenance costs[40], and cost less per mile to energize[41]. But until EV chargers can eliminate range anxiety, and until EV chargers can supply enough energy, reliably and as fast as the ICE alternative, our nation will not reach its EV adoption goals. We need more innovation. We need it fast. And more patents in EV charging may be the key.

Conclusion

Product performance, and not the presence of patents, has been the far more significant barrier to EV charging competition. When it comes to EV charging competition, more (not fewer) patents―fueled by more (not less) innovation―can be the driver that accelerates us forward into an EV dominated auto industry. Until then, charge at home whenever possible, avoid long road trips in your EV, and if you need to charge while on the road, rest assured that the patent system probably is not the cause of your range anxiety.

About Justin Philpott

Justin M. Philpott is a partner at the law firm Banner Witcoff. He drives an EV powered by his home’s solar panels, and yes, he does experience range anxiety from time to time. While not driving, he counsels clients on various intellectual property matters, with a particular emphasis on patent portfolio development and with a significant interest climate tech. He welcomes new clients looking to make a difference in the EV charging space and climate tech generally. He may be contacted at jphilpott@bannerwitcoff.com and https://www.linkedin.com/in/justin-philpott/.

[1] https://caredge.com/guides/electric-vehicle-market-share-and-sales

[2] https://evadoption.com/ev-sales/ev-sales-forecasts/

[4] https://www.tesla.com/impact/product

[5] https://www.caranddriver.com/news/a44405743/tesla-ev-chargers-highly-rated-jd-power/ (quoting JD Power’s survey)

[6] https://www.caranddriver.com/news/a44405743/tesla-ev-chargers-highly-rated-jd-power/ (quoting JD Power’s survey)

[7] https://www.consumerreports.org/cars/hybrids-evs/tesla-superchargers-open-to-other-evs-what-to-know-a9262067544/

[8] https://prospect.org/infrastructure/transportation/2023-08-10-teslas-dominance-ev-charging-networks/

[9] https://www.epa.gov/enforcement/volkswagen-clean-air-act-civil-settlement

[10] https://electrificationcoalition.org/work/federal-ev-policy/inflation-reduction-act/

[11] https://www.forbes.com/wheels/features/ev-range-cost-confidence-survey/

[12] https://www.washingtonpost.com/climate-environment/2023/12/13/electrify-america-ev-charger-broken/

[13] https://www.consumerreports.org/cars/hybrids-evs/tesla-superchargers-open-to-other-evs-what-to-know-a9262067544

[14] https://prospect.org/infrastructure/transportation/2023-08-10-teslas-dominance-ev-charging-networks/

[15] https://www.tesla.com/legal/additional-resources#patent-pledge

[17] https://www.tesla.com/blog/opening-north-american-charging-standard

[18] https://www.consumerreports.org/cars/hybrids-evs/tesla-superchargers-open-to-other-evs-what-to-know-a9262067544/ (“BMW, Genesis, General Motors, Honda, Hyundai, Jaguar, Kia, Lucid, Mini, Mercedes-Benz, Nissan, Polestar, Rivian, Toyota, and Volvo have said that their vehicles will also be Supercharger compatible starting in 2024. Mazda, Stellantis, and Volkswagen Group of America (Audi, Porsche, Scout Motors, and Volkswagen) will implement Tesla’s North American Charging Standard (NACS) connector on vehicles starting in the 2025 model year.”)

[19] https://www.via-la.com/licensing-2/ev-charging/

[20] https://www.avanci.com/iot/evcharger/

[21] https://witricity.com/media/press-releases/witricity-brings-wireless-charging-to-automobility-los-angeles

[22] https://www.via-la.com/licensing-2/ev-charging/ev-charging-license-fees/

[23] https://www.avanci.com/iot/evcharger/

[24] https://www.transportation.gov/rural/ev

[25] https://www.economicsobservatory.com/what-can-we-learn-about-patents-and-innovation-from-the-past

[26] https://www.uspto.gov/web/patents/classification/cpc/html/cpc-Y02T.html

[27] https://www.uspto.gov/patents/laws/patent-related-notices/climate-change-mitigation-pilot-program (listing Y02T at Form PTO/SB/457: https://www.uspto.gov/sites/default/files/documents/sb0457.pdf)

[28] https://www.lumenci.com/post/the-race-to-charge-evs-patents-and-the-future-of-transportation

[29] https://caredge.com/guides/electric-vehicle-market-share-and-sales (citing data from Wards Intelligence)

[30] https://www.tesla.com/legal/additional-resources#patent-pledge (calculated based on titles of patents relating to EV charging technology)

[31] https://www.via-la.com/wp-content/uploads/Final-January-1-2024-EV-Charging-Attachment-1.pdf (as of January 1, 2024)

[32] https://www.avanci.com/iot/evcharger/ (“Does the program cover 5G smart EV chargers? [Answer:] Not today, but we are exploring the potential for a 5G program. Contact us if this is of interest to you either as a licensor or an EV charger manufacturer or charge point operator.”)

[33] https://www.fcc.gov/consumers/guides/plan-ahead-phase-out-3g-cellular-networks-and-service

[34] https://www.energy.gov/eere/vehicles/batteries-charging-and-electric-vehicles

[35] https://www.nrel.gov/transportation/wireless-electric-vehicle-charging.html

[36] https://www.transportation.gov/rural/ev/toolkit/ev-infrastructure-funding-and-financing/overview

[37] https://highways.dot.gov/newsroom/biden-harris-administration-announces-623-million-grants-continue-building-out-electric

[38] https://www.transportation.gov/rural/ev

[39] https://www.bloomberg.com/news/features/2023-01-06/welcome-to-the-age-of-extreme-acceleration

[40] https://www.forbes.com/sites/jimgorzelany/2022/10/06/by-the-numbers-what-it-costs-to-maintain-an-electric-vehicle/?sh=18a612cd64d3

[41] https://www.greencars.com/expert-insights/cost-to-maintain-an-electric-car

Posted: April 16, 2024